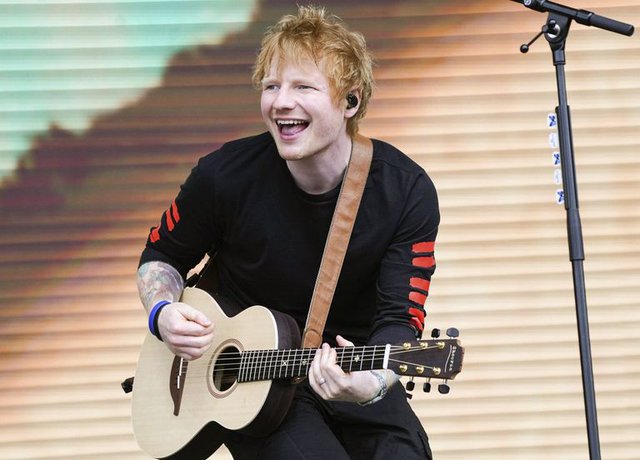

The famous male singer has very strict spending principles.

Thanks to hits like Shape of You, Bad Habits, Castle on the Hill and Perfect, Grammy Award-winning singer-songwriter Ed Sheeran has an estimated net worth of about $200 million (nearly 5 trillion Vietnamese Dong), according to CelebrityNetWorth.com. But despite having a comfortable financial life, Ed Sheeran is still incredibly frugal.

Say no to branded goods, shop for discounted items

1. Allowance of $1,000 per month

With assets worth trillions of dong, he can be classified as super-rich, but Ed Sheeran controls his own spending very strictly with a monthly pocket budget of $1,000 (about 25 million dong). ). Ed Sheeran is known as a homeless artist who rose to become a wealthy international star. Perhaps his previous life helped him understand the importance of saving.

2. Say no to branded products

Many super-rich celebrities like to spend their cash on luxury cars and designer clothes. But that’s not Ed Sheeran.

Instead of buying a fleet of luxury cars, Ed Sheeran decided to only buy a single Aston Martin DB9 car, about nearly 7 billion VND at the present time. Regarding clothes, it can be seen that the male singer often wears normal, simple outfits. “I don’t really spend a lot of money,” Ed Sheeran shared in 2014.

3. Shop for discounted items

Ed Sheeran told the Irish Examiner: “I had a look on Amazon, they were giving out free DVDs. I bought 200 movies.” When asked why a wealthy celebrity like him would care about discounted DVDs, the male singer simply said: “You never want to waste money.”

4. Invest money in real estate

Over the years, Ed Sheeran has amassed a huge real estate portfolio. He owns 27 real estate properties in prime locations, worth a total of about 86 million USD (more than 2 trillion VND). Among the real estate that Ed Sheeran owns are many houses in London with values ranging from 1.72 to 31 million pounds (50 – 893 billion VND). The male singer also owns a bar in the trendy Notting Hill district.

All the assets were bought outright, so Ed Sheeran saved money by not having a mortgage and his net worth benefited from increased real estate values. Furthermore, he rents out properties, earning extra money as a landlord. For example, the average rent in London’s posh Holland Park area, where he owns a mansion, is £909 (26 million VND) per week.

Tips to save every penny, set reasonable spending limits

Many financial experts say setting a spending limit is a smart way to save more. Certified financial planner Marguerita Cheng encourages people to set themselves a monthly allowance because it can help them manage their money effectively. And it allows you to spend comfortably within a safe range.

“A stipend essentially allows you to choose how to allocate your monthly cash flow,” says Cheng. People often have shopping priorities and can often feel overwhelmed or stressed with their personal finances. An allowance gives each person and couple the opportunity to know they can enjoy today while still planning for tomorrow.”

A fixed budget can be especially useful for people who want to control what they are spending while having flexibility. “Those who feel like their spending is out of control can use this budgeting method to think about their spending in the short term instead,” says financial planner Danielle Miura of Spark Financials. for the long term”.

As for implementing an allowance strategy, Miura recommends using a prepaid card and recharging it every week. “Once you reach your weekly limit, you cannot spend any money for the rest of the week,” says Miura.

To figure out your spending, experts recommend adding up all your bills, savings contributions, investments and other essential living expenses and determining how much money you have left. can be used for items and experiences of your choice.

Having a spending limit will help you avoid spending inflation when your income and asset value increase. For example, Ed Sheeran, despite having a dreamy fortune, earning £75,000/day according to his 2019 financial report, the male singer still maintains his extremely minimalist standard of living.